Life Insurance in and around Katy

Protection for those you care about

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

- Houston

- Heights

- Bellaire

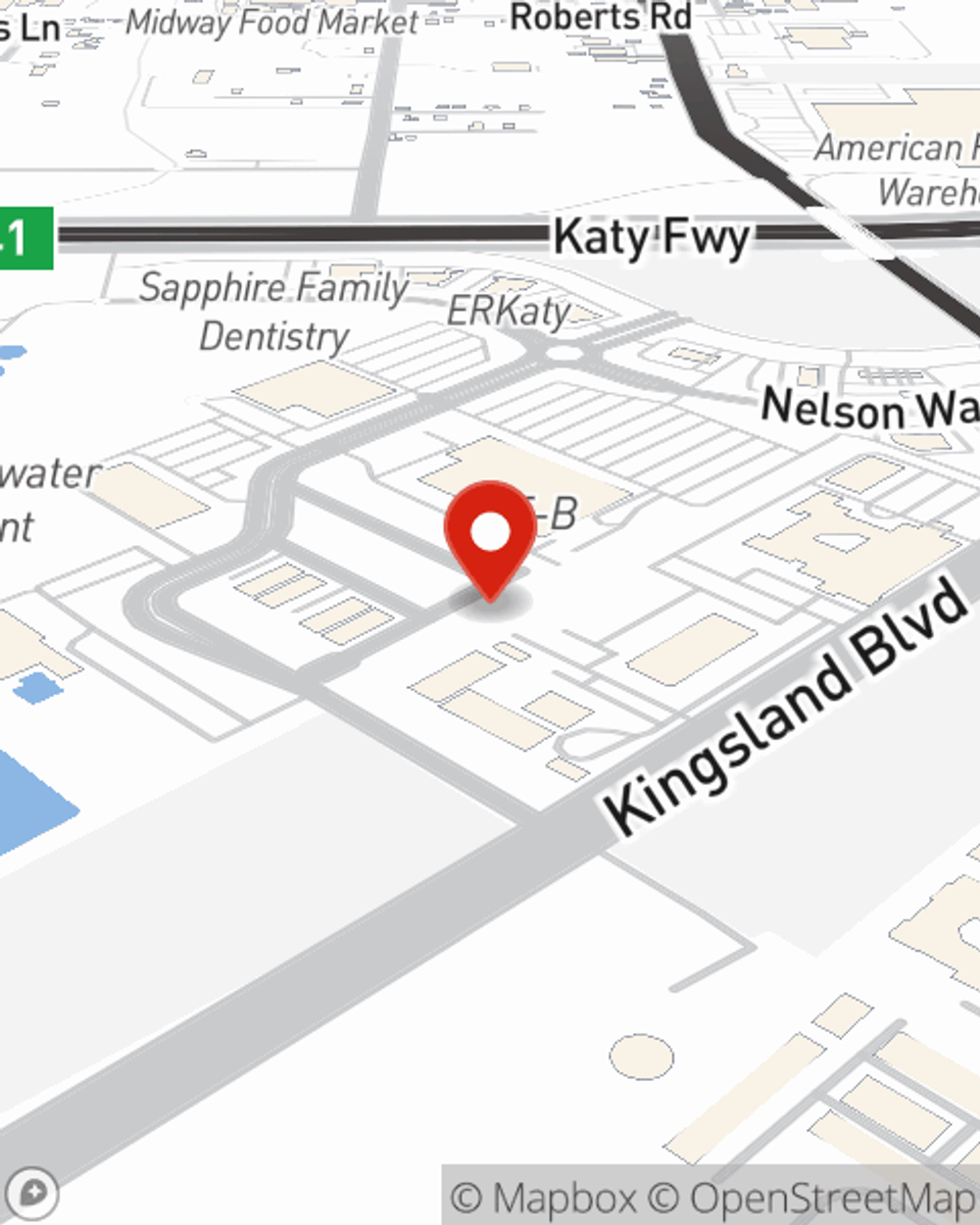

- Katy

- Galleria

- Inner Loop

- Memorial

- Energy Corridor

- River Oaks

- Montrose

- Pearland

- Spring Branch

- Timbergrove

- Garden Oaks

- Westchase

- Memorial Park

- Greater Uptown

- West University

- Meyerland

- Medical Center

- Midtown

- Upper Kirby

- Sugar Land

- Spring

Your Life Insurance Search Is Over

Can you guess the price of a typical funeral? Most people aren't aware that the common cost of a funeral today is $8,500. That’s a heavy burden to carry when they are facing grief and pain. If the ones you leave behind cannot pay for your burial or cremation, they may end up with large debts as a result of your passing. With a life insurance policy from State Farm, your family can survive, even without your income. Whether it keeps paying for your home, pays off debts or maintains a current standard of living, the life insurance you choose can be there when it’s needed most by your loved ones.

Protection for those you care about

Now is the right time to think about life insurance

Their Future Is Safe With State Farm

Some of your options with State Farm include coverage for a specific time frame or level or flexible payments with coverage designed to last a lifetime. But these options aren't the only reason to choose State Farm. Agent Andrew Graesser's terrific customer service is what makes Andrew Graesser a great asset in helping you opt for the right policy.

Simply reach out to State Farm agent Andrew Graesser's office today to see how the State Farm brand can work for you.

Have More Questions About Life Insurance?

Call Andrew at (281) 822-8850 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Andrew Graesser

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.